Loan origination can reduce processing complexity reduce costs speed time to revenue and improve customer satisfaction. While the loan origination process is one of the most critical business processes for any bank or lending institution banks. Today are working with an increasingly challenging and dynamic operating environment pressures include rising costs.

They cost to close on a typical mortgage has increased by double digits since the financial crisis of recent years customer demand customers want more transparency in the process fewer exceptions and a better experience, They also want to do business the way, they want to interact via mobile devices the Internet in person over the phone and more compliance requirements increasing industry regulations are driving more strict adherence to processing standards as a result profits are declining for many institutions who now need to be more efficient and competitive in order to thrive banks who want to stay competitive need to stay ahead of these market and customer base trends.

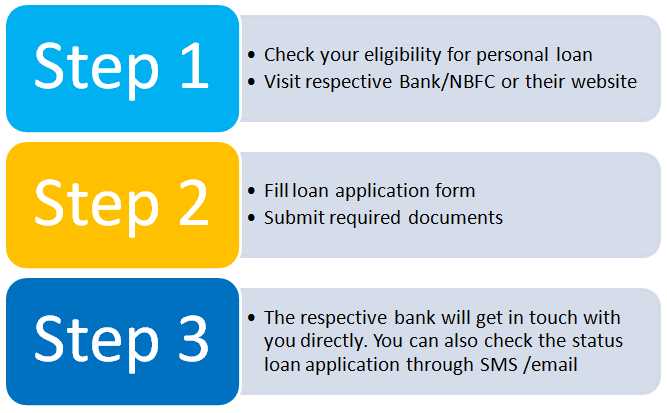

How to Get a Loan to Start a Business?. Business loans for new startup businesses are particularly risky because the bank doesn't have any proof of your ability to successfully

https://www.digilytics.ai

Title-AutoAftermarket

Content- Bus aftermarket Rearmost Breaking News, Pictures, Vids, and Special Reports from The Economic Times. bus aftermarket Blogs, Commentary and Archive News on The Australian Bus Aftermarket Expo features over 250 top Australian brands with the rearmost vehicle form & servicing outfit, relief corridor Bus Aftermarket with a track record for harmonious quality and delivery over 50 decades.

Url-

Loan origination can reduce processing complexity reduce costs speed time to revenue and improve customer satisfaction. While the loan origination process is one of the most critical business processes for any bank or lending institution banks. Today are working with an increasingly challenging and dynamic operating environment pressures include rising costs.

They cost to close on a typical mortgage has increased by double digits since the financial crisis of recent years customer demand customers want more transparency in the process fewer exceptions and a better experience, They also want to do business the way, they want to interact via mobile devices the Internet in person over the phone and more compliance requirements increasing industry regulations are driving more strict adherence to processing standards as a result profits are declining for many institutions who now need to be more efficient and competitive in order to thrive banks who want to stay competitive need to stay ahead of these market and customer base trends.

Revolutionize your Loan Origination Process with our product RevEI. RevEI is a ground-breaking AI Technology Product to Streamline Loan Origination Process. For more info visit: www.digilytics.ai and call us : +44 208 947 0137.

A Ground-Breaking AI Technology Product to Streamline its Loan Origination Process

Digilytics AI today announced that Together Financial Services, a specialist mortgage and secured loan provider, delivering common-sense decisions for business and personal customers, has implemented Digilytics™ RevEl, a software product leveraging ground-breaking Artificial Intelligence technology, for their loan origination process.

To read more visit our website-

https://www.digilytics.ai/pres....s-release-Together-F

- 30 posts

-

- Male

- 07-05-94

- Living in United Kingdom